SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

the Securities Exchange Act of 1934

| (2) | ||

![[MISSING IMAGE: lg_k12new-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-118562/lg_k12new-bw.jpg)

27, 2020

PERSON (VIRTUALLY).

15, 2020 You will not be able to attend the Annual Meeting in person. You will be able to vote and submit your questions at the website listed above during the Annual Meeting.20182020 ANNUAL MEETING OF

STOCKHOLDERS TO BE HELD ON

DECEMBER 14, 2018("Company"(“Company”), will be heldconducted via a live webcast at the law firm of Latham & Watkins LLP, 555 Eleventh Street, N.W., Suite 1000, Washington, D.C. 20004-1304,www.virtualshareholdermeeting.com/LRN2020 on Friday,Tuesday, December 14, 2018,15, 2020, at 10:00 A.M., Eastern Time ("(“Annual Meeting"Meeting”).eight (8)ten (10) directors to the Company'sCompany’s Board of Directors each to serve for a one-year term;2.("(“Say on Pay"Pay”);3.Company'sCompany’s independent registered public accounting firm for the fiscal year ending June 30, 2019;2021; and4.2018,2020, the record date, will receive notice of and be allowed to vote at the Annual Meeting. The foregoing matters are described in more detail in the Proxy Statement. In addition, financial and other information about the Company is contained in the Annual Report to Stockholders for the fiscal year ended June 30, 2018 ("2020 (“Annual Report"Report”), which includes our Annual Report on Form 10-K for the fiscal year ended June 30, 2018 ("2020 (“fiscal 2018"2020”), as filed with the U.S. Securities and Exchange Commission ("SEC"(“SEC”) on August 8, 2018.This year we12, 2020.26, 2018.For admission27, 2020.stockholders should comeduring regular business hours, for a period

stockholder status.

|

Executive Vice President, General Counsel and Secretary

October

27, 2020

15, 2020

| | ||||||||

| | | | | 1 | | | ||

| | | | | | 4 | | | |

| | | | | | | | ||

| | | |||||||

| | |||||||

| | 7 | | | ||||

| | | | | | 7 | | | |

| | | | | | 8 | | | |

| | | | | | | | ||

| | | | | | 8 | | | |

| | | | | | 11 | | | |

| | | | | | 12 | | | |

| | | | | | 15 | | | |

| | | | | | 15 | | | |

| | | | | | 18 | | | |

| | | | | | 20 | |||

| ||||||||

| | | | | | 21 | |||

| ||||||||

| | | | | | | | ||

| | | | | | 24 | | | |

| | | | | | 24 | | | |

| | | | | | 25 | | | |

| | | | | | 27 | |||

| ||||||||

| | | | | | | ||

| ||||||||

| ||||||||

Compensation Governance, Process and Incentive Decisions | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| ||||||||

PROPOSAL 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITOR | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | |

DECEMBER

15, 2020

other matters as may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting.

be supplemented by telephone or personal solicitation by our directors, officers or other regular employees of the Company. No additional compensation will be paid to our directors, officers or other regular employees for these services.

during the Annual Meeting?

your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

Annual Meeting?

Attention: Investor Relations

2300 Corporate Park Drive

Herndon, VA 20171

(703) 483-7000

48 Wall Street, 22nd Floor

New York, New York 10005

(800) 431-9633

Banks and brokers may call (212) 269-5550

Communication with Directors. Stockholders and other interested parties may communicate directly with our Board of Directors, individually or as a group, by sending an email to our General Counsel at OGC@K12.com, or by mailing a letter to K12 Inc., 2300 Corporate Park Drive, Herndon, VA 20171, Attention: General Counsel and Secretary. Our General Counsel will monitor these communications and provide summaries of all received communications to our Board of Directors at its regularly scheduled meetings. Where the nature of a communication warrants, our General Counsel may decide to seek the more immediate attention of the appropriate committee of the Board of Directors or an individual director, or our management or independent advisors and will determine whether any response is necessary.

information that he can use to assist the Chairman and CEO to function in the most effective manner. The Board of Directors believes the Lead Independent Director provides additional independent oversight of executive management and Board matters.

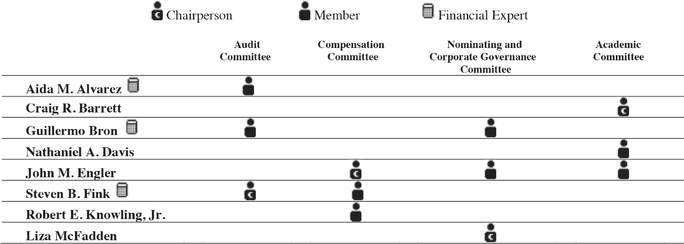

![[MISSING IMAGE: tm2032777d1-tbl_committeebw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-118562/tm2032777d1-tbl_committeebw.jpg)

control over financial reporting, and applicable requirements regarding auditor independence;

Onplans; and

Nominating and Corporate Governance Committee

Ms. Mmes. McFadden and Alvarez and Messrs. Bron and Engler qualify as independent directors within the meaning of the applicable NYSE listing requirements and SEC regulations. Our Board of Directors has adopted Corporate Governance Guidelines which are available on our website at www.K12.com.

In fiscal 2017,inquiries; and

participated in three meetings of the Company'sCompany’s Educational Advisory Committee (“EAC”) during fiscal 2018.2020. Under its charter, the responsibilities of the Academic Committee include:

•- Our Compensation Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs, and retains outside compensation and legal experts for that purpose, as further explained in the Compensation Committee Report which begins on page

55.45.••Finally, our Nominating and Corporate Governance Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to the management of risks associated with the organization, membership and structure of the Board of Directors, succession planning for our directors and corporate governance.Director Compensation for Fiscal20182020

In fiscal2018,2020, pursuant to our Amended Non-Employee Directors Compensation Plan("(“Directors CompensationPlan"Plan”), our non-employee directorsreceivedwere eligible to receive annual cash retainers for service on the Board of Directors and assigned committees and annual restricted stock awards. Mr. Davis, our Chairman and CEO, received no additional compensation for his service on our Board of Directors.Amounts paid to Mr. Chavous, our President, Academics, Policy and Schools, for his partial year of service as a non-employee director during fiscal 2018 are set forth below in our "Summary Compensation Table for Fiscal 2018".Pursuant to the terms of the Directors Compensation Plan, each non-employee director receives an annual cash retainer of$60,000$70,000 and an additional amount for each committee on which the non-employee director serves, as shown below: Additional Cash

Retainer Committee Chair Member Audit Committee $35,000 $10,000 Compensation Committee $15,000 $5,000 Nominating and Corporate Governance Committee $10,000 $5,000 Academic Committee $5,000 $5,000 Additional Cash

RetainerCommittee Chair Member Audit Committee

$35,000 $10,000 Compensation Committee

$15,000 $5,000 Nominating and Corporate Governance Committee

$10,000 $5,000 Academic Committee

$5,000 $5,000 The Directors Compensation Plan also provides forIn January 2020, each non-employee director received an annual restricted stockawards for each non-employee director,award valued at$100,000$120,000 as of the grant date,(prorated for a partial year of service),with the shares of our Common Stock underlying such awards vesting fully

The following table sets forth the compensation paid to our non-employee directors for their services during fiscal 2018:

| | Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($) (1) | | | Total ($) | | | | |

| | Aida M. Alvarez (2) | | | 78,750 | | | 120,000 | | | 198,750 | | | | |

| | Craig R. Barrett (3) | | | 75,000 | | | 120,000 | | | 195,000 | | | | |

| | Guillermo Bron (4) | | | 75,000 | | | 120,000 | | | 195,000 | | | | |

| | Robert L. Cohen (5) | | | 85,000 | | | 120,000 | | | 205,000 | | | | |

| | John M. Engler (6) | | | 85,000 | | | 120,000 | | | 205,000 | | | | |

| | Steven B. Fink (7) | | | 110,000 | | | 120,000 | | | 230,000 | | | | |

| | Victoria D. Harker (8) | | | 20,000 | | | 108,163 | | | 128,163 | | | | |

| | Robert E. Knowling, Jr. (9) | | | 85,000 | | | 120,000 | | | 205,000 | | | | |

| | Liza McFadden (10) | | | 80,000 | | | 120,000 | | | 200,000 | | | | |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) (1) | Total ($) | | ||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

Aida M. Alvarez (2) | 70,000 | 100,000 | 170,000 | |||||

| | | | | | | | | |

Craig R. Barrett (3) | 65,000 | 100,000 | 165,000 | |||||

| | | | | | | | | |

Guillermo Bron (4) | 75,000 | 100,000 | 175,000 | |||||

| | | | | | | | | |

John M. Engler (5) | 85,000 | 100,000 | 185,000 | |||||

| | | | | | | | | |

Steven B. Fink (6) | 100,000 | 100,000 | 200,000 | |||||

| | | | | | | | | |

Robert E. Knowling, Jr. (7) | 30,719 | 97,264 | 127,983 | |||||

| | | | | | | | | |

Liza McFadden (8) | 61,236 | 141,376 | 202,612 | |||||

| | | | | | | | | |

Jon Q. Reynolds (9) | 16,250 | — | 16,250 | |||||

| | | | | | | | | |

Andrew H. Tisch (10) | 36,250 | — | 36,250 | |||||

| | | | | | | | | |

(1)- Represents the aggregate grant date fair values of stock awards computed in accordance with FASB ASC Topic 718. On January 2,

2018,2020, each non-employee director who held such position at the beginning of the calendar yearreceivedwas eligible to receive an award of6,2085,961 shares of restricted stock. Ms. Alvarez, Mr. Cohen, Mr. Knowling and Ms. McFadden elected to receive their awards in deferred stockthat vestsunits under the Directors Deferred Compensation Plan. The restricted stock and deferred stock units vest on January 2,2019.2021.

ELECTION OF DIRECTORS

71

Directors.

81

68

66

Communications and Telica, Switching.Inc. Mr. Davis holds an M.B.A. from the Wharton School of the University of Pennsylvania, an M.S. in Engineering Computer Science at the Moore School of the University of Pennsylvania, and a B.S. in Engineering from Stevens Institute of Technology. Mr. Davis was selected as a director based on his strong record of executive management, finance and systems engineering skills, as well as his insight into the considerations necessary to run a successful, diverse global business. The Board of Directors also benefits from his previous service on other public company boards and his experience in accounting and financial reporting.

72

69

65

an independent non-profit corporation created by Chancellor Joel I. Klein and Mayor Michael R. Bloomberg that is chartered with developing the next generation of principals in the New York City public school system. Mr. Knowling has also held roles as Chief Executive Officer of Telwares, Chairman and Chief Executive Officer of SimDesk Technologies, Inc. and Chairman, President and Chief Executive Officer of Covad Communications. He was awarded the Wall Street Project'sProject’s Reginald Lewis Trailblazers Award by President Clinton and the Reverend Jesse Jackson in 1999. Mr. Knowling serves on the board of directors for Roper Technologies, Inc., Rite Aid Corporation and Stream Companies. He also previously served on the board of Heidrick & Struggles, Inc. from 20101999 to 2015, Hewlett Packard Company from 1999 to 2005 and Convergys Corporation from 2017 to 2018. He holds a B.A. in theology from Wabash College and an M.B.A. from Kellogg School of Management, Northwestern University. Mr. Knowling was selected as a director based on his experience in public education, public company leadership roles, technology and organizational development.

58

64

56

Venable, LLP, Shearman and Sterling, LLP, and the United States Securities and Exchange Commission. He began his legal career at Venable, LLP. Mr. Mathis formerly served on the Boardboard of Directorsdirectors of Indianapolis Power and Light Company Enterprises, Inc., AES Tietê Energia S.A., and AES Elpa S.A. In addition, he previously served on the Boardboard of Directorsdirectors at IPALCO Enterprises, Inc., DPL Inc. and The Dayton Power and Light Company and was Chairman of Eletropaulo Metropolitana Eletricidade de São Paulo S.A. Mr. Mathis holds a J.D. from the University of Virginia and a B.A. in Economics and Political Science from The University of Richmond.

50

We achieved solid

solutions.

In fiscal 2017 we saw this approach begin to yield some positive results and in fiscal 2018 our core business delivered further improvements in financial, operational and academic performance. Although our stock price has continued to face headwinds from the issues identified above, revenue growth, profitability and capital expenditures for the year met or exceeded our guidance and we saw the highest

student retention level in eight years. Based on these outcomes, we believe the strategy begun three years ago has worked in many respects, and during this time we formed an executive leadership team that is poised to continue the trend. To ensure the continuity of this progress, Mr. Davis was selected as the person best suited to spearhead K12's leadership team in its current phase and he re-assumed the position of CEO during fiscal 2018, a position he previously held from January 2014 to February 2016.

We have identified the following four cornerstones on which we intend to focus our efforts to accelerate our business growth and education mission:

•#1 Strengthening Our Core—Our Managed Public School programs remain the foundationoverall success of our business and aligns their interests with those of our stockholders. Consistent with this philosophy, we reward our executives for superior performance relative to our key financial and operational metrics that drive stockholder value and improve theimprovements in retention makes us optimistic about its strength and potential for growth.•#2 Preparing Studentsacademic outcomes for theFuture—We are focused on building a more comprehensive career readiness program with a distinct brand and better linkage to corporations, trade associations, and higher education institutions.•#3 Becoming a Trusted Advisor—Our management team is proactively complementing our content and services sales approach by positioning our Institutional business as a trusted software services provider delivering end to end digital learning solutions.•#4 Going Global—We continue to develop international opportunities by building partnership-focused relationships with in-country organizations.

We believe that by actively pursuing these strategic priorities, stockholders in K12 will realize the benefits of strong revenue and profitability growth, and just as importantly, see their investment provide educational choices and exceptional learning opportunities for students and families across the nation.

Stockholder Engagement and Compensation Reforms and Highlights

As we developed our executive compensation program for fiscal 2018, our Compensation Committee took into account the extensive stockholder input we received and took steps to more tightly link executive pay to measurable performance results. Over the last several years, we have extensively overhauled our executive compensation programs and practices, including making the following structural changes prior to fiscal 2018 (which were continued into fiscal 2018):

- serve. Fiscal 2020 highlights include:

Following these reforms, the annual stockholder advisory vote on our executive compensation for fiscal 2017 yielded an approval rate of 78.5%, which was a significant improvement over prior years. We view this as an endorsement of the positive changes we have made, but also recognize that it still reflects lingering concerns among a portion of our stockholder base. To understand, address and respond to those concerns consistent with the fiduciary duties of the Board of Directors, during fiscal 2018 we maintained our stockholder outreach efforts with the goal of receiving meaningful feedback. Accordingly,

at the beginning of fiscal 2018, we proactively reached out to our top 25 stockholders, speaking with a total of five stockholders that responded and in the aggregate held over 20% of our shares outstanding. Our Investor Relations and Human Resources leaders conducted the outreach efforts, with the Chairman of the Compensation Committee participating in some of the calls. We continued these discussions during the year through written correspondence and in-person stockholder meetings to continue our executive compensation dialogue.

The stockholders that we spoke with recognized and commended our continued responsiveness to their feedback such as the elimination of overlapping performance metrics in short- and long-term incentive pay programs and the introduction of longer term performance metrics in our 2016 LTIP.

These conversations centered on three key themes, which we have sought to address in a careful and deliberative manner so as to further our strategic business objectives:

Leadership Structure and Total Compensation Cost.

•Key Stockholder Concerns. Our stockholders expressed concerns over the total compensation cost associated with maintaining separate positions of an Executive Chairman and CEO with distinct roles and each receiving significant compensation amounts.•Fiscal 2018 Highlight—Streamlined Leadership Team. With the mid-year departure of Mr. Udell, our Board of Directors determined that a single executive position undertaken by Mr. Davis with his deep knowledge of our operations, relations with our major school board customers, and architect of our going forward strategy, would best serve the Company's needs at this time. During fiscal 2018 we consolidated the separate roles of a distinct CEO and Executive Chairman into the position of Chairman and CEO. We will continue to evaluate our executive leadership needs as we execute on our strategic business goals and priorities. To maintain flexibility and ensure that stockholders are not overly burdened with excessive severance costs, we also negotiated an arrangement that would eliminate our cash severance obligations to Mr. Davis in the event Mr. Davis is replaced by a new CEO. This resulted in a one-time equity incentive award for Mr. Davis that is subject to meaningful performance and other vesting conditions, which are described below under the heading "—Determination of Long-Term Incentive Compensation—Mr. Davis-Performance Based Restricted Stock Awards."•Fiscal 2018 Highlight—Reduced Leadership Compensation Burden. The consolidation of our Chairman and CEO positions resulted in an annual cost savings to the Company (based on total target-level compensation, including equity incentives) of approximately $1.8 million. In his role as Chairman and CEO, Mr. Davis' total target-level compensation package was set at a level comparable to his prior tenure in the CEO position, which ended in fiscal 2016.•Fiscal 2018 Highlight—No Salary Increases. As in fiscal 2017, we sought to limit total compensation costs by generally maintaining base compensation at prior year levels. Other than in connection with Mr. Davis assuming increased CEO duties, none of our NEOs received any increase in base salaries or target total compensation levels for fiscal 2018.

Annual Bonus Plan Structure and Payouts

•Key Stockholder Concerns. Our stockholders expressed concerns relating to our bonus plan structure, particularly its reliance for certain executives on individual performance goals and the use of quantitative metrics that overlap with our long-term incentive program. A few

•Fiscal 2018 Highlight. In our continued effort to align our pay for performance practices with our strategy and stockholder value creation, we focused on restructuring our annual bonus plan for fiscal 2018, which included:•Eliminating individual criteria for our CFO, previously eliminated for our Chairman and CEO during fiscal 2017, and continuing to decrease the weighting of individual performance management objectives ("PMOs") for other executive officers from 50% to 30%.•Reducing the number of corporate PMOs for our most senior executives so that our annual bonus plan is tied to driving stockholder value through achievement of key financial metrics, operational goals and academic performance.•Removing performance metrics that overlap with our performance-based equity incentive awards to ensure that executives do not receive duplicate payouts for a singular achievement.•Updating the corporate PMOs to focus our executives on advancing our strategic priorities, which included adding a new a metric tied to our career and technical education ("CTE") enrollments.

•Fiscal 2018 Highlight. As the only publicly traded company in the K-12 space, comparison to our peer companies for purposes of setting target compensation levels present unique challenges. As a result, our stock price returns may not correlate strongly with our peer group. Going forward, to ensure alignment of realized pay amounts with corporate performance, we are enhancing our commitment toward establishing rigorous corporate level performance goals in our annual incentive program. Specifically, we set the fiscal year 2018 threshold performance targets at levels above the actual results for fiscal 2017 and target performance levels are directly tied to 2018 budgeted performance. Additionally, payout for threshold performance was reduced from 50% to 30% of target bonus.

stockholders also questioned why above-target bonus payouts were provided in years where our stock price performance has trailed members of our compensation peer group.

Long-Term Incentive Plan Structures

•Key Stockholder Concern. Our stockholders expressed concerns about the use of one-year performance periods for certain equity awards granted to our most senior executives and noted our lack of relative stockholder return metrics in our long-term incentive programs.•Fiscal 2018 Highlight. We implemented a relative total stockholder return metric on a trial-basis to the performance-based restricted stock awards granted to our NEOs for fiscal 2018, other than Mr. Davis and Mr. Udell. Performance-based awards for these NEOs are subject to attaining free cash flow goals, subject to increase or decrease in a range of 75% to 125% based on our relative total stockholder return as compared to the component companies in the Russell 2000 Index.•Fiscal 2018 and 2019 Highlight. Other than Mr. Chavous, who joined the Company in the fall of fiscal 2018, our NEOs participated in a three-year LTIP that was introduced in fiscal 2016. The fiscal 2016 LTIP was an overperformance plan based on achievement of specific targets over a three-year performance period with no overlapping periods or awards. The purpose of the program was to encourage achievement of strategic initiatives related to academic improvement and an increase in student lifetime value. This plan was still in place

during fiscal 2018, concluding in early fiscal 2019. To complement the existing three-year LTIP, we utilized a one-year performance period for certain equity awards to our most senior executives in fiscal 2018 to incentivize disciplined focus to drive profitability and financial stability as we continued to execute against our multi-year business plan. In setting this performance period for fiscal 2018, we also took into account the fact that equity awards granted to Mr. Davis were 100% performance-based in fiscal 2018, which we believe is a far heavier burden than the compensation practices of our peer companies. For fiscal 2019, we have eliminated one-year performance periods from our long-term incentive programs for key executives. Performance based equity incentives for fiscal 2019 for Mr. Davis, Mr. Rhyu and Mr. Chavous are based entirely on a three-year performance period and will be earned only if we realize significant stock price appreciation as of the end of the three-year period.

While executing on our multi-year strategy as described above, fiscal 2018 saw solid financial results and key achievements in the following areas:

•- Managed Public School Retention. Research shows that students who remain in the same school setting longer generally perform better academically so improving student retention in our virtual schools is a key aspect of our business strategy. We ended fiscal 2020 with student retention rates at their highest level ever. Retention rates at our managed public schools improved by more than

300210 basis points over fiscal20172019 andwe sawby 550 basis points over thehighest student retention level in eightpast three years. •Student Enrollments.Our total average student enrollments continued to increase, with 105,000 students enrolling inRetention remained a component of ourprograms duringExecutive Bonus Plan for fiscal2018, resulting in a 4.8% increase over fiscal 2017.•School Academic Performance.Since fiscal 2016, we achieved more than a 95% success rate in maintaining schools that we no longer consider to have academic performance issues, reducing2020 for thenumber of schools that we consider to be in "academic jeopardy" from 11 to 5.Named Executive Officers.

| | |||||||||||||||||

| | | | | Performance | | | | ||||||||||

| Fiscal Performance | |||||||||||||||||

| | | | Fiscal 2019 | | | ||||||||||||

| | | Income | | | | ||||||||||||

| $ | |||||||||||||||||

| | | | |||||||||||||||

| $ | |||||||||||||||||

| | | | | | |||||||||||||

| | | Revenue | | | | $1,015.8M | | | | $1,029.8M | | | | 1.4% | | |

For fiscal 2018 our cash flow, profit and revenue metrics were expressed on an "adjusted" basis to eliminate the impact of certain extraordinary and variable elements that are beyond the control of our executives.Please refer to the discussion titled"Fiscal 2018“Fiscal 2020 CompensationDecisions"Decisions” beginning page2925 for a discussion of how these non-GAAP financial measures are calculated.•Continued Expanding Our Career Readiness Education Offering.•Expanded Business Operations.We continued toexpandbuild upon ourbusiness operations and focused on developing our CTE programs,Career Readiness offering, highlights of whichinclude openingincluded expanding our career readiness training into the adult education and corporate training markets and acquiring Galvanize, which provides talent development for individuals and enterprises in the information technology fields. For Dr. McAlmont, the President of our Career Readiness Education programs, anew programmeaningful portion of his annual bonus for fiscal 2020 was based on the achievement of performance metrics designed to grow our Career Readiness business. Executives inOhio, developingother organizations also share responsibility in the performance metrics around growing this line of revenue.Say on Pay Results and Stockholder Engagement94.48% of the shares voted at our 2019 annual meeting of stockholders voted to approve our named executive officer compensation for fiscal 2019, reflecting our stockholders’ strong support of our executive pay programs and practices. We recognize the significance of stockholder support of our executive compensation programs and continued our stockholder outreach efforts during fiscal 2020. We remained committed to responding to stockholder feedback on our executive compensation programs and the committee considers all feedback to ensure that our programs are tightly linking executive pay to measurable performance results.At the beginning of fiscal 2020, we proactively reached out to our largest 35 stockholders, speaking with a total of seven stockholders that responded and in the aggregate held over 24% of our shares outstanding.Our Investor Relations and Human Resources leaders, as well as the Chairman of the Compensation Committee, conducted the outreach efforts. No significant concerns were raised by the stockholders and several noted key improvements in our executive compensation practices, including our increased focus on performance-based awards tied to quantifiable metrics, our enhanced disclosure of stockholder outreach efforts and our continued responsiveness to stockholder and proxy advisory firm feedback. An area referenced for further consideration involved utilizing performance periods of varying lengths in our equity incentive programs. This concept is reflected in our fiscal 2020 executive compensation program. For fiscal 2020, each NEO received an annual long-term incentive award granted in the form of performance-based restricted shares that vest based on financial performance measured at the end of one year, with any earned shares subject to additional time-based vesting over threenew project-based learning centersyears. The CEO also received a performance-based restricted stock award that is earned andmaking significant equity investments in businessesvests over a three-year performance period. Additionally, our NEOs hold performance stock units that areintended to address market demand for CTE, in addition to our core business.earned and vest based on stock price performance at the end of a three-year performance period, which performance will be measured after the close of fiscal 2021.

fixed in the form of base salary.

Carefully Consider Stockholder Input. We regularly seek and engage in dialogues with our stockholders on executive compensation matters. RecentOngoing enhancements into our executive compensation programs have beenare influenced by these discussions.

For fiscal 2021, we increased our share ownership requirements for our CEO from three times base salary to five times base salary and all other executive officers must now maintain a minimum share ownership of two times base salary.

risk-taking.

| | | Element | | | | | | | Purpose | | | |||

| | ||||||||||||||

| | Base Salary | | | | Evaluated annually by the Committee and reviewed in light of market pay practices. Represents a lower percentage of target total direct compensation than at most peer companies, with average base salaries benchmarking near the | | | | Provide a monthly income necessary to retain executives. | | ||||

| | ||||||||||||||

| | | Executive Bonus Plan | | | | |||||||||

Annual performance determines payouts. Ties a meaningful portion of target annual cash compensation to attaining | | | | Focus executives on attaining financial and strategic performance objectives from year to year. | | |||||||||

| | ||||||||||||||

| | | Long-Term Incentives | | | | |||||||||

Time-based Performance-based restricted stock awards: Performance targets are | | | | Enhance retention of key executives who drive consistent performance. Motivate and reward executives for achievement of long-term goals | ||||||||||

| | | |||||||||||||

| | | Other Compensation | | | |

| Executives may participate in benefit programs on the same terms as other employees, such as health and welfare benefit plans, 401(k) plan, life insurance and executive life and disability plans. Executives may elect to participate in a non-qualified deferred compensation plan providing tax-efficient savings, but receive no additional Company contributions. Premiums for | | | | Provides benefits having high perceived values and offers tax advantages. | ||||||||

| | |

The Committee has assessed Compensia’s independence and concluded that no conflict of interest exists that would prevent Compensia from providing services to the Committee.executives,executive officers, including our NEOs. In fiscal 2018,2020, the Committee continued to engage Compensia, an independenta national compensation consultant company to evaluate the market competitiveness of compensation for our executive officers. Compensia'sCompensia’s work for the Committee also included an assessment of the compensation practices of peer group companies, severance pay programs and a subsequent executive compensation market analysis.

| | |||||||||||

• ACI Worldwide, Inc. • Adtalem Global Education, Inc. (formerly DeVry Education Group) • American Public Education, Inc. • Blackbaud, Inc. • Zovio (formerly Bridgepoint Education, Inc. ) | | | • Perdoceo Education | ) • Chegg Inc. •

Graham Holdings Co. • Grand Canyon Education, Inc. | • Houghton Mifflin Harcourt Co. • Huron Consulting Group | | | • Laureate Education • Scholastic Corporation • Strategic Education (formerly Strayer Education, Inc. ) • Weight Watchers International, Inc. • Zynga, Inc. • 2U, Inc. | |

Laureate Education.

positions at the companies in the peer group. The Committee used this analysis when reviewing and adjusting the compensation levels of our NEOs for fiscal 2020. This peer group was also used by Compensia to prepare an analysis of executive severance and change in control arrangements during fiscal 2020, which the Committee considered when determining to enter into new severance and change in control arrangements with our NEOs.

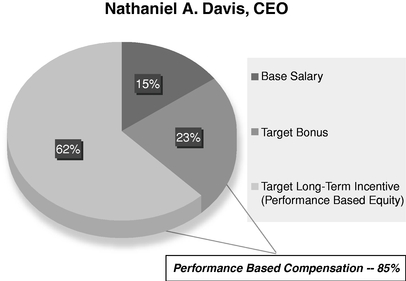

Chairmancompensation, and CEO Pay Mix

Compensia assisted the Committeeprovide executive severance and change in designing competitive pay packagescontrol agreements that focus heavily on variable pay components,are aligned with the intent that compensation for our Chairmanpeer group and CEO should be overwhelmingly performance-based. A graphic illustration of the basic annual total target pay mix of our Chairman and CEO, which is set forth in his employment agreement, is depicted below:

Other

| Name | Base Salary for Fiscal 2018 | |||

|---|---|---|---|---|

| | | | | |

Nathaniel A. Davis | $ | 735,000 | (1) | |

| | | | | |

James J. Rhyu | $ | 500,000 | ||

| | | | | |

Kevin P. Chavous | $ | 490,000 | (2) | |

| | | | | |

Howard D. Polsky | $ | 385,000 | ||

| | | | | |

Allison B. Cleveland | $ | 415,000 | ||

| | | | | |

(1)

| | Name | | | Base Salary for Fiscal 2019 | | | Base Salary for Fiscal 2020 | | | Percentage Increase | | ||||||

| | Nathaniel A. Davis | | | | $ | 735,000 | | | | | $ | 935,000 | | | | 27% | |

| | Timothy J. Medina | | | | | — | | | | | $ | 475,000 (1) | | | | — | |

| | James J. Rhyu | | | | $ | 515,000 | | | | | $ | 575,000 | | | | 12% | |

| | Kevin P. Chavous | | | | $ | 497,350 | | | | | $ | 511,850 | | | | 3% | |

| | Shaun E. McAlmont | | | | $ | 415,000 | | | | | $ | 480,000 | | | | 16% | |

| | Vincent W. Mathis | | | | $ | 405,000 | | | | | $ | 415,000 | | | | 2% | |

April 13, 2020. The Committee reviewed a competitive assessment of executive compensation levels for chief financial officer positions prepared by Compensia in determining an appropriate base salary for Mr. Medina.

PMOs for our Chairman and CEO and, for all our NEOs, removing performance metrics that overlap with our performance-based equity incentive awards. Beginningmanagement objectives (“PMOs”) utilized in fiscal 2017, we eliminated bonus payouts for achieving individual goals for our Executive Chairman and CEO and, for fiscal 2018,2019 because the Committee extended thisbelieves these key metrics, which are related to our CFOprofitability, growth and did not apply individual goalsbusiness initiatives, are closely tied to driving stockholder value.

Targetthe target annual bonus levels for our NEOs are reviewed by the Committee annually and set at levels that, when combined with base salary levels, are intended to provide target total cash compensation opportunities that approximate the market median. NoneFollowing its review of our NEOs receiveda competitive assessment of executive compensation levels prepared by Compensia, the Committee approved an increase into the target annual bonus levelsopportunities for Mr. Rhyu and Dr. McAlmont under our Executive Bonus Plan for fiscal 2018.2020. Target bonus levelsopportunities for our NEOs for fiscal 20182020 were as follows:

| | Name | | | ||||

| Target Bonus (% of Base Salary) | |||||||

|---|---|---|---|---|---|---|---|

| | |||||||

| Nathaniel A. Davis | ||||||

| | | | | 150% | | | |

| James J. Rhyu | ||||||

| | | | | 100% | | | |

| Kevin P. Chavous | ||||||

| | | | | 80% | | | |

| |||||||

| | | | | 80% | | | |

| |||||||

| | | | | 65% | | | |

metricsCorporate and Individual PMOs to be included in our Executive Bonus Plan each fiscal yearyear. Over the past several years, the Committee has

| | | |||||||

| | | | | | ||||

| | | | | | ||||

| Adjusted Operating Income | | | ||||||

| | | | | | ||||

| Revenue | ||||||||

| | | |||||||

| | | Key Business Initiatives | | | | |||

| | |

2019. In addition, even though the threshold, target and maximum improvement levels for student retention in the 2020 Executive Bonus Plan were lower than the corresponding threshold, target and maximum improvement levels set in the 2019 Executive Bonus Plan, in order for the NEOs to earn any portion of the bonus for this metric, our student retention performance needed to improve meaningfully over 2019 levels.

| | Weighting | | | | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Metric | CEO/CFO | Other NEOs | Performance Level | Achievement | Actual Results | |||||

| | | | | | | | | | | |

| Adjusted | Threshold | $42.1M | ||||||||

| | | | | | | | | | | |

| Operating | 40% | 28% | Target | $46.8M | $49.2M | |||||

| | | | | | | | | | | |

| Income (1) | Outperform | $51.5M | ||||||||

| | | | | | | | | | | |

| Threshold | $888.5M | |||||||||

| | | | | | | | | | | |

| Revenue | 10% | 7% | Target | $914.3M | $917.2M | |||||

| | | | | | | | | | | |

| Outperform | $940.9M | |||||||||

| | | | | | | | | | | |

| Threshold | 103.7K | |||||||||

| | | | | | | | | | | |

| MPS Average | 10% | 7% | Target | 107.6K | 108.7K average enrollments | |||||

| | | | | | | | | | | |

| Enrollments (2) | Outperform | 111.6K | ||||||||

| | | | | | | | | | | |

| Threshold | 200 bps | |||||||||

| | | | | | | | | | | |

| Retention (3) | 20% | 14% | Target | 240 bps | Improvement 320 bps | |||||

| | | | | | | | | | | |

| Outperform | 320 bps | |||||||||

| | | | | | | | | | | |

| Threshold | 1400 | |||||||||

| | | | | | | | | | | |

| CTE Average | 20% | 14% | Target | 1600 | 1702 | |||||

| | | | | | | | | | | |

| Enrollments (4) | Outperform | 1800 | ||||||||

| | | | | | | | | | | |

Metric Weighting (4) Performance Levels Actual

Results (5) Payment

Percentage Adjusted Operating Income (1) 40% Threshold $63.0M $75.1M 173.3% Target $70.0M Outperform $77.0M Revenue (2) 40% Threshold $1,015.8M $1,029.8M 81.9% Target $1,035.0M Outperform $1,055.7M Retention (3) 20% Threshold 25 bps Improvement 210 bps 200% Target 100 bps Outperform 200 bps Overall Weighted Payment Percentage 142.1% (1)Operating income isFor purposes of the Executive Bonus Plan, “operating income” was adjusted for stock-based compensation expense andexcludesmay exclude anyacquisition relatedacquisition-related charges (which would include amortization subsequent to an acquisition transaction) and any other unusual, non-recurring gain or loss that is separately identified and quantified in our financial statements.(2)(2)Measures average student enrollment atRevenue may be adjusted for any unusual, non-recurring event that is separately identified and quantified in ourmanaged public schools over the school year.financial statements.(3)(3)Measures the overall improvement in retention rate of students that are active in our Managed Public SchoolProgramsprograms on or after June 1st and thepercentpercentage of these students that remain active at the end of the school year, or on May 31st, subject to certain exclusions for students ineligible to return (e.g., graduating students) or commence enrollment until the following school year.(4)(4)Measures average student enrollment atIn place of theDestinationRetention metric, Dr. McAlmont’s third metric included an individual PMO directly tied to growth of our CareerAcademy schools, whetherReadiness programs as described below.(5)In evaluating actual results for fiscal 2020, the Committee considered the impact from the acquisition of Galvanize ina stand-alone academy or in a managed public school with a destination career academy program. Enrollment is calculatedJanuary 2020 and determined that 2020 Executive Bonus Plan awards would be based ona nine-month averagefinancial results that excluded the impact of theending enrollment for each month from October through May.Galvanize acquisition. Accordingly, actual performance with respect to our achievement against the adjusted operating income and revenue PMOs reflects adjustments made to exclude amounts attributable to the Galvanize acquisition.

Individual PMOsForMr. PolskyDr. McAlmont, an individual PMO replaced the Retention metric of the corporate PMOs andMs. Cleveland, individual PMOsaccounted for30%20% ofthe NEO'shis target annual bonus opportunity under the Executive Bonus Plan for fiscal2018,2020, although the Committee retains discretion to allow for individual adjustments based on factors and considerations it deems relevant.A general description ofIn August 2020, the Committee reviewed Dr. McAlmont’s achievement against his individualPMOs for fiscal 2018PMO and theNEOs' achievementsresults areprovided below.included in the following table. Individual Goals Performance Results Produce a run rate of DCA enrollments that support the long-term DCA plan of record based on the following performance levels on July 1, 2020:•Threshold: 11,000 DCA enrollments•Target: 13,500 DCA enrollments•Outperform: 16,000 DCA enrollments NEOIndividual GoalsPerformance ResultsHoward D. PolskyFavorable outcomes in significant litigation, arbitration, and state regulatory matters;Completion of teacher certification compliance database;Implementation of share repurchase;Student data privacy initiatives and executive FCPA and securities law trainingMr. Polsky achieved his established goals and outperformed with respect to obtaining favorable outcomes in significant litigation and state regulatory matters; effectively managed an unplanned share repurchase transaction; and implemented a years' long compliance project. The CEO and the Board of Directors determined that Mr. Polsky's substantial achievements warranted an outperform result for his individual goals.156.6%16,200 DCA enrollmentsOutperform (200%) Allison B. ClevelandImprove student and family satisfaction and engagement;Renew 8 contracts and 10 charters;Improve teacher satisfaction and implement programs to build a more effective teacher workforce;Grow the number of Destination Career Academy schools and students enrolled in Career and Technical Education schools and coursesMs. Cleveland achieved her established goals and outperformed in the areas of improved family satisfaction, and engagement where a greater than 10% increase was attained in Net Promoter Score and a student retention improvement of more than 300 bps. Additionally, the number of Destination Career Academy schools more than doubled and students enrolled in CTE programs and courses outperforming against that metric.112.4%28Fiscal20182020 Executive Bonus Plan PaymentsThe following tableillustrates,sets forth, for each NEO, theCommittee'sCommittee’s approved annual bonus award under our Executive Bonus Plan for fiscal20182020 based upon performance against the corporate PMOs and, for Dr. McAlmont, performance againstthe executive'shis individual PMOs. Corporate PMOs NEO (1) Adjusted

Operating

Income Revenue Retention Individual

PMOs % of Target

Bonus Earned Amount of Bonus Nathaniel A. Davis 69.3% 32.8% 40% — 142.1% $1,992,841 James P. Rhyu 69.3% 32.8% 40% — 142.1% $817,029 Kevin P. Chavous 69.3% 32.8% 40% — 142.1% $581,839 Shaun E. McAlmont 69.3% 32.8% — 40% 142.1% $545,634 Vincent W. Mathis 69.3% 32.8% 40% — 142.1% $383,293 (1)Corporate PMOs Adjusted

Operating

IncomeNEO Revenue MPS Average

EnrollmentsRetention CTE Average

EnrollmentsIndividual

PMOs% of Target

Bonus EarnedAmount of

Bonus Nathaniel A. Davis (1)

60.5% 11.09% 12.8% 40% 30.2% — 154.6% $1,704,087 James P. Rhyu

60.5% 11.09% 12.8% 40% 30.2% — 154.6% $618,263 Kevin P. Chavous (2)

60.5% 11.09% 12.8% 40% 30.2% — 154.6% $388,439 Howard D. Polsky

42.3% 7.8% 8.9% 28% 21.1% 46.9% 155.2% $388,329 Allison B. Cleveland

42.3% 7.8% 8.9% 28% 21.1% 33.7% 141.9% $382,859 (1)- Mr.

Davis' 2018Medina was not eligible for a fiscal 2020 annual bonusaward is calculated based on his base salary of $735,000. To seek to maintainbecause he was hired during thetax deductibility of awards under our Executive Bonus Plan for certain executive officers, we historically established a performance-based "umbrella" bonus plan that was intended to qualify bonus payouts as "performance-based compensation" for purposes of Section 162(m)fourth quarter of theInternal Revenue Code. Under this plan, annual bonus awards for our most senior executives (which forfiscal2018 would be Mr. Davis and Mr. Udell) would not exceed 10% of our adjusted operating income for theyear.Based on our adjusted operating income for fiscal 2018, this would have resulted in a maximum combined possible bonus award of $3,150,000. In light of Mr. Udell's termination and Mr. Davis assuming the role of CEO during the fiscal 2018 performance period, the Board determined not to utilize the "umbrella" bonus plan in making annual bonus award calculations; however, the combined total payouts for both executives were less than the maximum amount permitted under the plan in any event. Due to the passage of the Tax Cut and Jobs Act of 2017 (the "Tax Act"), which generally eliminated our ability to rely on the "performance-based compensation" exception under Section 162(m), we no longer intend to utilize an "umbrella" bonus plan going forward. (2)The amount shown for Mr. Chavous was pro-rated for his partial year of service with us.

In connection with his termination as CEO effective March 3, 2018, Mr. Udell became entitled to receive the severance amounts under his employment agreement, which included a pro-rated portion of the annual bonus he would have received for the year of termination, based upon actual performance for such year and paid at the same time annual bonuses are generally paid to the Company's senior executives. Based upon achievement of the corporate PMOs described above, and pro-rated for the portion of fiscal 2018 during which he served as CEO, Mr. Udell received an annual bonus payment for fiscal 2018 of $1,004,677.Determination of Long-Term Incentive CompensationWe believe that providing long-term incentive compensation opportunities in the form of equity awards promotes our philosophy of aligning executive pay with the long-term interests of our stockholders while building the value of our Company.DuringWe have historically used a one-year financial performance metric in our executive equity award program and we believe this has played an important role in ensuring that executive performance can be measured against goals that can be reliably determined. To complement our annual equity award program in fiscal2018,2019 wegrantedadopted a long-term shareholder performance plan as a means of providing multi-year performance-basedRSAsequity incentive awards designed toMr. Davisencourage our NEOs to focus on executing our key strategic objectives. Awards under this program were entirely performance-based andperformance- and time-based RSAs to eachwill be earned only if we realize significant stock price appreciation as ofMr. Rhyu, Mr. Chavous, Mr. Polsky and Ms. Cleveland. In a departure from prior years, nonethe end of fiscal 2021.Fiscal 2020 Annual AwardsThe fiscal 2020 annual equity awards for our NEOs weregranted market-based awards that would be earned based solely on attaining stock price levels.Mr. Davis—Performance-Based Restricted Stock AwardsIn early fiscal 2018, the Committee approved Mr. Davis' long-term incentive award in the formcomprised entirely ofperformance-basedrestricted stockwith a cash flow goal measured by Adjusted EBITDA minus CapitalExpenditures ("CapEx")awards, which were divided equally between time- and performance-based awards. The following table sets forth the target award values for the NEOs for fiscal2018. Unlike many members of our peer group, in fiscal 2018 we did not grant time-vesting equity awards to our most senior executive.The performance-based RSAs granted to Mr. Davis for fiscal 2018 had a target award value of $2 million, as set forth in his employment agreement,2020 and the resulting number of restricted sharesgrantedsubject to each type of award, which wasdeterminedbased upon the fair market value of our Common Stock on the date of grant. Awards to the CEO were recommended by the Compensation Committee and reviewed and approved by the independent members of the Board of Directors. Mr. Medina commenced service with us in late fiscal 2020 and did not receive an annual equity award for the year. NEO Annual Equity

Award Value Number of

Time-Based

Shares Number of Performance-Based Shares Threshold Target Outperform Nathaniel A. Davis $3,000,000 53,744 42,995 53,744 71,480 James P. Rhyu $2,000,000 35,829 28,663 35,829 47,653 Kevin P. Chavous $1,200,000 21,497 17,198 21,497 28,591 Shaun E. McAlmont $1,000,000 17,914 14,331 17,914 23,826 Vincent W. Mathis $700,000 12,540 10,032 12,540 16,678 Time-Based Restricted Stock Awards. The time-based restricted stock awards granted to our NEOs for fiscal 2020 vest based on our standard vesting schedule which is semi-annually over a three year period, with 20% of the shares subject to the award vesting in the first year and 40% vesting in each of the next two years following the grantwhich resulted in a target award of 110,865 shares.date.29Performance-Based Restricted Stock Awards. The performance-based restrictedsharesstock awards are earned baseduponon the attainment of Adjusted EBITDAminus CapExperformance levels for fiscal20182020 as set forth in the following table,below,with any earned shares subject to additional time-based vesting in equal annual installments over a period of threeyears.years from the date of grant. Financial achievement falling between the specified levels would result in a proportionate adjustment to the number of shares earned.Performance LevelMetric: Adjusted EBITDA-CAPEX% of Award Earned Below ThresholdLess than $57.4M0%; entire award forfeitedPerformance Level % of Award Earned Threshold$57.4M80% of award earned Below Threshold Target<$ 66.5M-$76.5M100% of award earnedOutperform$84.2M133% of award earned134M Award Forfeited Threshold $134M 80% Target $141M 100% Outperform $148M 133% TheCompensationCommittee determined tocontinue using the cash flow metric ofuse Adjusted EBITDAminus CapExas the metric forthis awardour NEOs’ annual equity awards becausewe viewit views this as a critical metric for driving stockholder value.EBITDA is a non-GAAP financial measure that consists of net income, plus net interest expense, income tax expense, depreciation and amortization minus noncontrolling interest charges. A reconciliation of EBITDA to the U.S. GAAP financial measure of operating income is provided in Item 6 of our fiscal20182020 Annual Report on Form 10-K. EBITDA is adjusted for stock-based compensation expense andexcludesmay exclude any acquisition related charges (which would include amortization subsequent to an acquisition transaction) and any other unusual, non-recurring gain or loss that is separately identified in our financial statements.In evaluating actual results for 2020, the Committee considered the impact from the acquisition of Galvanize in January 2020 and determined to exclude amounts attributable to the Galvanize acquisition when evaluating the Adjusted EBITDA metric for purposes of the performance-based restricted stock awards.

In setting the threshold, target and outperform levels forthis award for 2018,these awards, the Committeetook into account that 100% of the equity awards for Mr. Davis are performance-based and therefore at-risk. The Committee also considered that this is a meaningful departure from the compensation practices of our peer companies, many of which provide at least half of their annual equity incentive grants in the form of time-based awards,was committed to establishing rigorous performance goals and set threshold performancelevels accordingly. In our continued focus to align our metrics to our approved budgetabove actual performance for fiscal 2019 andyear-over-year improvement, the metrics for Mr. Davis' equity award provided thattarget performancebetween prior years' results and the approved budget would result in target level attainment. Additionally, payoutsateach performance level are set in a narrower band than many programs of our peer companies to ensure that executives do not receive unreasonable payouts in the event of outperformance, taking into account the challenges we face in projecting our performance levels in our current operating environment and as we execute on transitioning our business.fiscal 2020 budgeted performance.

In early fiscal2019,2021, the Committee determined that our fiscal20182020 Adjusted EBITDAminus CapExwas$82.4$143 million, which resulted inMr. Davisthe NEOs earningan awarda number of138,898shares between the Target and Outperform levelsone-thirdas set forth in the following table. One-third ofwhichthese shares vested in August2018,2020 on the date of certification of achievement, and the remainderof whichwill vest inannualequal installments in August 2021 and 2022. NEO Number of

Performance-

Based Shares Earned Nathaniel A. Davis 58,811 James P. Rhyu 39,207 Kevin P. Chavous 23,524 Shaun E. McAlmont 19,603 Vincent W. Mathis 13,722 CEO One-Time Equity AwardAs a means of ensuring Mr. Davis’ retention and continued commitment to the Company, in August 2019and 2020.CEO Grant. In connection with Mr. Davis' appointment as CEO,the independent members of the Board granted Mr. Daviswas granteda one-time performance-based restricted stock award having a value of$2,205,000,$10,000,000, resulting in a grant of158,747358,294 restrictedshares.shares based on the fair market value of our Common Stock on the date of grant. The awardwas granted in recognition of our agreement with Mr. Davis to eliminate the Company's severance payment obligations to Mr. Davis under his employment agreement upon the appointment of a successor CEO. This award converted the value associated with Mr. Davis'lump sum cash severance payment of three times his base salary (which would be payable upon an involuntary termination coincident with a successor CEO appointment) into an equity incentive performance award designed to retain Mr. Davis for an indefinite period of time and to drive him to deliver a concrete strategic plan for the Company to execute into the future. The shares subject to this award vest as to 50% of the award upon the hiring and commencement of employment of a new CEO. This component of the award was designed to seek to ensure Mr. Davis' retention and commitment to the Company until such time as his ultimate successor is selected and appointed by the Board. Because no specific timeline has been established for any such succession, this requires Mr. Davis to remain with us for an indefinite period of time to attain this portion of the award. The remaining 50% of the awardonly vestsupon Mr. Davis' submission to the Board of a strategic plan for the Company and the Board's acceptance of the same. On October 17, 2018, the Board received and accepted the long-term strategic plan presented by Mr. Davis. Upon Mr. Udell's departure, Mr. Davis was re-appointed to the CEO position because we believed that he was best positioned to set our company and the students we serve on track for future success. This component of the award was designed with these efforts in mind and will vest only after Mr. Davis completes work, to the full satisfaction of the Board, to develop the concrete steps and strategies for the Company to execute on the four cornerstones that we believe will accelerate our business growth and education mission, specifically to strengthen our core business, prepare students for the future, become a trusted software services provider in our Institutional Business and to further expand globally.Mr. Rhyu, Mr. Polsky and Ms. Cleveland—Time- and Performance-Based Restricted Stock AwardsBeginning in August 2016, the Committee increased the percentage of variable compensation for certain of our NEOs in order to better align the interests of these executives with those of our stockholders and redefined business strategy. For fiscal 2018, the Committee reevaluated the long-term incentive component of our executive compensation program and determined to continue placing a meaningful amount of the NEOs' regular annual equity awards "at risk" such that 20% of the annual restricted stock awards granted to each of Mr. Rhyu, Mr. Polsky and Ms. Cleveland are performance-based. For fiscal 2018, a portion of their annual equity awards aresubject to attaining free cash flow goalsand the Committee also introduced a total stockholder return modifier on a trial-basisover three one-year performance periods asan element of this program. The performance-based restricted shares are earned based upon the attainment ofset forth in the followingfree cash flow performance levels for fiscal 2018:table. Performance

Year Performance

Level Portion of Award

Earned Vesting Date Performance LevelMetric: Free Cash Flow% of Award Earned FY 2020 $Below ThresholdLess than $49.5M0%; entire award forfeitedThreshold$49.5M50% of award earned60M 1/3 August 15, 2021

FY 2021Target $ 55M65M 100% of award earned 1/3

OutperformAugust 15, 2021 $60.5M125% of award earned FY 2022 $ 70M 1/3 August 15, 2022 For purposes30Awards are earned and vest on the second and third anniversaries of theperformance-based restricted shares granted to Mr. Rhyu, Mr. Polsky and Ms. Cleveland,grant date as set forth in the table above. In the event the free cash flow goal for a given performance year isdefinednot attained, the shares eligible to be earned for such year will remain eligible to vest on August 15, 2022 if cumulative free cash flow for fiscal years 2020, 2021 and 2022 equals or exceeds $195 million.Free cash flow is calculated as cash flow from operations, lessCapEx. Financial achievement falling betweencapital expenditures, as reported to and accepted by thelevels set forth inboard or thetable above would result in a proportionate adjustment to the number of shares earned.Committee.In setting the performance levels for this award, the Committeesetevaluated historical performance and considered potential future strategic investments.In early fiscal 2021, thetarget level atCommittee determined that ourbudgeted level for 2018 and the threshold level at a meaningful amount above our actual 2017 results.After determining the initial payout level for the performance-based restricted shares based on actualfiscal 2020 free cash flowresults forwas $35.4 million, which resulted in Mr. Davis not earning theyear, the payout percentageinitial one-third of the shares subject to this award. These shares may vest on August 15, 2022, if the cumulative free cash flow for fiscal years 2020, 2021 and 2022 equals or exceeds an aggregate $195 million threshold for such three-year period.Medina New Hire AwardsIn connection with commencing employment with us in April 2020, Mr. Medina was granted a time-based restricted stock awardis then adjusted upwards or downwardsTablehaving a value ofContentsin a range$800,000. The number of75% to 125%shares granted was determined based upon the fair market value ofthe initial calculated payout level dependingour Common Stock on theCompany's total stockholder return ranking as compared to companiesdate of grant, which resulted inthe Russell 2000 Index as follows:Performance LevelRelative TSR PerformanceModifier to % of Award EarnedThreshold25th percentile or below25% reduction ofan awardTarget50th percentile0% (no change to award)Outperform75th percentile or above25% increase of awardPerformance falling between the levels set forth in the table above would be interpolated linearly between the threshold, target and outperform levels. For purposesofthis modifier, total stockholder return is determined by using the average stock price over the 90 days preceding the end of the fiscal year.34,782 restricted shares. The

following table sets forth the number of time and performance-based restricted stock awards granted to each of Mr. Rhyu, Mr. Polsky and Ms. Cleveland for fiscal 2018:Name Time RSAs

(#) (1)Performance-Based RSAs

(#) (2) James J. Rhyu

34,170 8,540 Howard D. Polsky

20,340 5,080 Allison B. Cleveland

24,410 6,100 (1)The time-based RSAs vest pursuant toaward vests based on our standard vesting schedule which is semi-annually over a three-year period, with 20% of the shares subject to the award vesting in the first year and 40% vesting in each of the next two years following the grant date.(2)The performance-based RSAs are

In addition, Mr. Medina was granted performance stock units (“PSUs”) that will be earned and vest baseduponon theachievement ofCompany’s average closing stock price over thefree cash flow performance metric described above, as modified by our total stockholder return ranking as compared to companies in30 calendar day period that begins on theRussell 2000 Index. The restricted shares that are earned vest as to 20% of the shares uponeighth day after the date thedate the Committee determines achievement of the metricsCompany releases its earnings results for fiscal 2021. These PSUs are comparable to similar awards granted to our other NEOs in 2019 under our 2019 Shareholder Performance Plan andthe remaining 80% of the shares vest in four equal semi-annual installments thereafter. On August 1, 2018, the Committee determined thatwere granted as an initial long-term incentive award for Mr. Medina to align his interests and compensation with ourfiscal 2018 free cash flow was $63.5M, which resulted in base performance at the 125% "Outperform" level. However, our relative total stockholder return was at the 16th percentile of the companiesstockholders in theRussell 2000 Index, resultingsame way as the grants made to our other NEOs ina reduction of 25% of the award. Therefore, the NEOs earned awards at the 100% "Target" level.Mr. Chavous—New Hire GrantIn connection with his commencement of employment in October 2017, Mr. Chavous was granted a restricted stock award having a target award value of $1,000,000, allocated evenly between time- and performance-based restricted stock awards.2019. The number of sharesgranted was determined based upon the fair market value of our Common Stock on the date of grant, which resulted in an award of 30,212 time-based restricted shares subject to our standard vesting schedule whichthat would be earned by Mr. Medina at different stock price hurdles issemi-annually over a three-year period, with 20% of the shares subject to the award vestingset forth in thefirst year and 40% vesting in eachfollowing table. The number ofthe next two years following the grant date andPSUs earned will be interpolated on atarget award of 30,212 performance-based restricted shares with 60% of the performance-based shares (or 18,127 shares) earned upon the attainment of certain individual performance metrics and 40% of the performance-based shares (or 12,085 shares) earned upon attainment of the free cash flow performance levels for fiscal 2018 set forth above for Mr. Rhyu, Mr. Polsky and Ms. Cleveland, as modified by our total stockholder return ranking as compared to companies in the Russell 2000 Index.The following table sets forth the individual performance metrics applicable to a portion of Mr. Chavous' new hire grant and the results as determined by the Committee in August 2018. Based on its review of Mr. Chavous' performance against the individual metrics, the Committee determined that Mr. Chavous achieved 95% of his target award level for this component of his new hire grant, which resulted in Mr. Chavous earning an award of 17,220 restricted shares.MetricPerformance LevelAchievementDescriptionResultsThreshold10%Key Account RenewalTarget40%Renew, replace or transition key accounts for four "at risk" contract renewals by the end of fiscal 2018, each weighted at 10%Met for 2 accounts, partially met for 1 account and not met for 1 accountEarned: 25%Outperform40%Threshold5%Stride Phase 1PilotTarget10%Implement Stride Phase 1 pilot with demonstrated usage by target population by end of fiscal 2018Below threshold performanceEarned: 0%Outperform20%Threshold10%AcademicImprovementPlanMathImprovementPlanTarget10%Complete and obtain CEO approval on math improvement plan by end of fiscal 2018Met at target levelEarned: 10%Outperform20%Threshold5%AcademicModelsBlended PilotProgramsTarget10%Launch three new blended pilot programs by end of fiscal 2018 with evaluation planMet at target levelEarned: 10%Outperform20%Threshold10%New CTESchoolTarget20%Sign 4 new CTE schools by end of fiscal 20186 new schools signed resulting in achievement at the outperform levelEarned: 40%Outperform40%Threshold10%Board RelationsTarget10%Systematic approach and plan for Board relations approved by CEO by end of fiscal 2018MetEarned: 10%Outperform10%Prior Year Long-Term Incentive AwardsFiscal 2017 Market-Based Restricted Stock Awards

table.In fiscal 2017, Mr. Rhyu, Mr. Polsky and Ms. Cleveland were granted market-based restricted stock awards that begin to vest based upon the Company achieving an average stock price of $14.35 per share measured during the 30 consecutive calendar days following the report of fiscal 2017 earnings. On September 8, 2017, the Committee certified the achievement ofstraight-line basis if the stock pricethreshold andfalls between two of theNEOs began vestinglevels set forth in therestricted shares as follows: Stock Price Hurdle # of Shares Earned $22.63 35,352 $25.86 46,407 $29.38 51,055 $33.21 60,223 $37.35 66,934 $46.65 66,934 $57.38 66,934 NameMarket-Based RSAs(#) (1)James J. Rhyu16,000Howard D. Polsky7,000Allison B. Cleveland8,000(1)Restricted shares granted upon the achievement ofNo amounts will be earned if the stock priceappreciation threshold vest as to 20% of the shares immediately upon the date the threshold is achieved and as to 80% of the shares in four equal semi-annual installments thereafter.

LTIP Performance Share UnitsIn fiscal 2016 the Committee granted PSUs to our NEOs, which are earned based on academic performance, weighted at 70%, and a student lifetime value ("LTV") retention metric, weighted at 30%. Academic performance goals were measured over both a two and three year period and the student retention LTV metric was measured based on performance for the third year (fiscal 2018). The first tranche of the academic goal (i.e., the tranche for the two-year fiscal 2016-2017 period) was earned at the outperform level based on reducing the number of schools in academic jeopardy status over the performance period from 11 to three and began vesting in November 2017. The second tranche of the academic goal (i.e. the tranche for the three-year fiscal 2016-2018 period) was measured based on the percentage of schools not in academic jeopardyat the end of the performance periodas follows:Threshold90% of Schools70% of AwardEarnedTarget95% of Schools100% of AwardEarned��Outperform100% of Schools150% of AwardEarnedTableis below the $22.63 level. In the event ofContentsFor this purpose, "academic jeopardy" is defined asaschool having a high probability of being closed within 12-18 months ofchange in control during themeasurement date if academic performance does not improve. Over the three-yearperformance period,we reducedthenumber of schools in academic jeopardy from 11 to 5, resulting in the second tranche of this award being earned between the Threshold and Target levels, or 95.8% of the award being earned. The earned shares from the second tranche vested on August 15, 2018.The retention goal was eligible toPSUs will be earned based on theachievement of a student LTV metric, which takes into account our average revenue per student enrollment multiplied by the duration of our students' total enrollment life. The percentage growth figures shownstock price paid or implied in thetable below representtransaction and theamount of growth in LTV needed to be achieved by fiscal 2018 above the fiscal 2015 level.Threshold16% Growth70% of AwardEarnedTarget33% Growth100% of AwardEarnedOutperform52% Growth150% of AwardEarnedFor fiscal 2018, we achieved an LTV growth of less than 16%, resulting in the shares subject to the retention metric being forfeited.Theearnedacademic sharesPSUs will vestin four quarterly installments beginning August 15, 2018.Awards under the LTIP are not granted on an annual basis such that additional PSUs with overlapping performance periods were not granted to our NEOs. Fiscal 2018 was the final year of our 3-year LTIP, which was implemented in fiscal 2016.New 2019 Long-Term Shareholder Performance PlanFor fiscal 2019-2021, we have adopted a new long-term shareholder performance plan ("2019 SPP") that represents a meaningful portion of the total long-term incentive award opportunities provided to our most senior executives, Mr. Davis, Mr. Rhyu and Mr. Chavous. The awards are granted in the form of performance share units and will be earned only based on our market capitalization growth over a completed three-year performance period. The 2019 SPP was designed to provide these executives with a percentage of shareholder value growth. No amounts will be earned if total stock price growth over the three-year period is below 25% (7.6% annualized). A target amount of 6% of total value growth will be earned based on achieving total stock price growth of 33% (10% annualized) and a maximum of 7.5% of total value growth will be earned if total stock price growth equals or exceeds 95% (25% annualized).The total number of shares, and corresponding share of market cap growth, earned by each of Messrs. Davis, Rhyu and Chavous under the 2019 SPP at different stock price growth outcomes is illustrated in the following chart:immediately. Absolute Stock Price

GrowthShare of Market Cap

GrowthDavis # of Shares Earned

RhyuChavous 25% 1.0% 54,649 12,882 10,539 33% 6.0% 413,331 93,885 83,257 52% 6.5% 528,571 179,714 172,666 73% 6.5% 596,022 243,827 243,827 95% 7.5% 724,185 362,093 362,093 120% 7.5% 727,673 382,433 382,433 174% 7.5% 848,857 425,372 425,372 238% 7.5% 939,858 413,537 413,537 Deferred Compensation PlanWe maintain a non-qualified deferred compensation plan, or the Deferred Compensation Plan, under which our NEOs are eligible to elect to defer the receipt of up to 50% of their annual base salary and up to 100% of any annual incentive bonus until retirement. Earnings are credited on deferred amounts based upon a variety of investment options that may be elected by each participant. We do not make any31contributions to the Deferred Compensation Plan. Certain information with respect to amounts deferred by our NEOs under this plan is set forth below in the"Fiscal 2018“Fiscal 2020 Non-Qualified DeferredCompensation"Compensation” table.Defined Contribution PlanWe maintain a Section 401(k) Savings/Retirement Plan, or the401(k)“401(k) Plan,” in which certain of our employees, including our NEOs, are eligible to participate. All employees, including our NEOs, are automatically enrolled in the 401(k) Plan at a 3% deferral rate with the ability to opt-out. The 401(k) Plan allows participants to defer a portion of their annual compensation, subject to certain limitations imposed by the Internal Revenue Code. We currently provide matching contributions equal to $0.25 for each dollar of aparticipant'sparticipant’s contributions on the first 4% of eligible salary that they contribute each pay period, subject to certain statutory limits.Employee Benefits and PerquisitesWe provide our NEOs with certain personal benefits and perquisites, which we do not consider to be a significant component of executive compensation but recognize to be an important factor in attracting and retaining talented executives.Our NEOs participate in the same medical, dental, vision, disability and life insurance plans as our employees generally. We provide our NEOs with certain perquisites and other personal benefits, which we do not consider to be a significant component of our executive compensation programs but recognize to be an important factor in attracting and retaining talented executives. We also pay for supplemental long-term disability and life insurance premiums for our executive officers and provide them with the opportunity to receive annual Company-paid executive physical examinations and reimburse certain executives for their relocation expenses from time to time and for temporary housing expenses they may incur in connection with their provision of services. We provide these supplemental benefits to our executive officers due to the relatively low cost of such benefits and the value they provide in assisting us in attracting and retaining talented executives. None of our executive officers receive tax gross-ups or other tax payments in connection with our provision of any perquisites or personal benefits.In addition, Dr. McAlmont and Mr. Mathis were provided reimbursement of relocation expenses during fiscal 2020.The value of perquisites and other personal benefitsandperquisiteswe provided to each of our NEOs in fiscal20182020 is set forth below in our"Summary“Summary Compensation Table for Fiscal2018."Compensation Governance, ProcessAndand Incentive DecisionsRole of Compensation CommitteeThe Committee is responsible for overseeing our executive compensation programs, as specified in its charter. TheCommittee'sCommittee’s role includes:•Determiningdetermining and approving the compensation of our executive officers and recommendingto our Board of Directors the incentivecompensationand equity awards offor our Chairman and CEO,and approvingsubject to approval by thecompensation for our other executive officers, includingindependent members of theother NEOs;Board of Directors;••Establishingestablishing and approving compensation plans for our executive officers based on the recommendations of the Chairman andCEO, and the Committee's compensation consultant; andCEO;••Proposingproposing revisions to theCommittee'sCommittee’s charter for our Board ofDirectors'Directors’ approval to ensure compliance with new SEC regulations and NYSE listing standards asenacted.enacted; and